Polkadot is a blockchain consisting of a number of sharded chains, which means it might make many transactions on parallel chains (Parachains). Polkadot (DOT) is the native token for the Polkadot ecosystem.

Polkadot allows interoperability, which means it permits communication and switch of knowledge between unrelated blockchains in a easy, safe, and energy-efficient method. Why stake Polkadot? Staking Polkadot helps safe the Polkadot community.

What is Polkadot staking?

Polkadot staking is an effective means of locking up your DOT on a platform for the aim of incomes curiosity or serving to safe the ecosystem. Staked Polkadot is named Bonded Dot tokens.

Validators assist safe and scale the Polkadot ecosystem. With sufficient validators, the Polkadot community can course of as many as 1000 transactions in a second. On exchanges staking Dot helps present liquidity for merchants and lenders who borrow at curiosity. Pooled staking positions assist leverage decrease transaction charges and better payouts.

Polkadot is a decentralized user-driven neighborhood with all choices made on-chain. This means Polkadot avoids forks on its community. Polkadot is ranked quantity 12 with a market cap of $18B and has a Twitter following of over 1.2M.

How does Polkadot staking work?

Polkadot makes use of a nominated proof of stake (POS) consensus to approve the accuracy of transactions in its sharded blockchain. There are two methods of staking Dot; as a validator and as a nominator. In a nominated POS, nominators elect Validators (Node operators) by committing their Dot to them. You ought to word that solely 256 nominators ranked by their stake earn rewards from a validator, due to this fact staking as a nominator is an lively course of to make sure you don’t miss out on payouts.

Staking Dot as a validator is a hustle, making an error can have an effect on your score and sure result in the slashing of your bonded Dot. There is a dynamic minimal quantity of Dot required to grow to be a validator, with the utmost variety of node operators capped at 1000.

Both nominators and validators then get rewards for securing the Polkadot blockchain.

Staking as a validator is a extremely demanding job, we’re due to this fact going to take a look at how one can stake Dot tokens by being a nominator. Anyone with Dot tokens can act as a nominator.

Crypto exchanges additionally supply Dot staking. To stake on Binance you could create an account and full consumer verification earlier than you should purchase Dot tokens. Binance gives Dot staking on a locked and versatile foundation.

How to stake Polkadot with Polkadot-js Extension

Polkadot.js browser extension is an easy-to-use net extension Dot pockets. The pockets simply integrates and indicators transactions on Polkadot dAPPS and net 3 companies.

Polkadot pockets is a sizzling pockets which means it straight interacts with the staking platform. As a safety measure, it’s suggested to create two accounts on Polkadot-js. A stash account, to retailer your unbonded Dot stability and controller accounts to carry Dot that can actively work together with the staking platform. Always go away some Dot saved within the controller account for transacting charges when bonding or un-bonding Dot.

An individual has the choice of compounding curiosity or having the curiosity despatched to an exterior pockets handle for receiving staking rewards.

Step 1: In the Polkadot-js pockets create a controller and stash account.

Step 2: Visit Polkadot.js webpage

Step 3: Under the accounts tab, click on ‘Accounts’ then add your Polkadot-js extension pockets account to attach.

Step 4: Select staking beneath ‘Network on the drop-down menu.

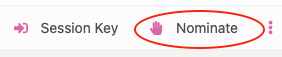

Step 5: Click the ‘+Nominator’ button on the prime

Step 7: Next choose your controller and stash accounts. Enter the variety of Dot to bond and select the way you need to get curiosity. This may very well be compounded or despatched to an exterior or stash pockets. After this click on ‘Next’

Step 8:On the subsequent display screen, select and add the validators you need then click on ‘Bond and nominate’.

Step 9: Input your password and signal the transaction to start out staking Polkadot in your bonded account.

Polkadot staking by way of a pool

A Cryptocurrency trade swimming pools cryptocurrencies to leverage greater curiosity for its dot holders. Polkadot will be staked by way of a pool on Binance and Kraken digital coin exchanges.

To stake on Binance and Kraken you first have to create and confirm accounts earlier than you’ll be able to stake. After creating the account, deposit Polkadot or buy on the trade. Both exchanges have excessive Polkadot liquidity.

Kraken rewards payout is biweekly and the dot funds are despatched to their rewards vacation spot within the trade.

Binance gives Dot slot auctions. These are auctions that enable initiatives to compete for slots (Parachains) on the Polkadot community. The venture with the very best staked Dot token (Bdot) wins the public sale. Stakers are awarded by Binance a share of $30M in rewards in the course of the public sale interval. Winning initiatives reward their stakers whereas losers have their Bdot refunded. Slots are leased to initiatives for a most of 96 days and in the course of the interval Bdot is locked into the venture.

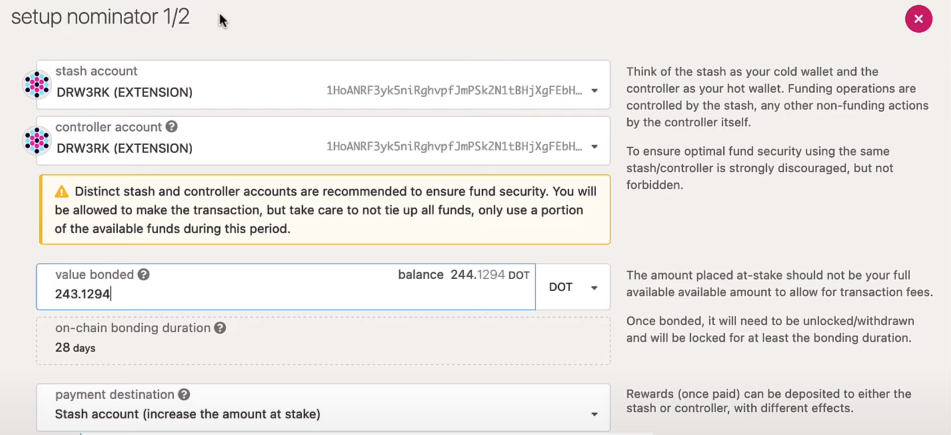

Binance gives each versatile and stuck staking for Polkadot. In fastened staking, DOT is locked up into Binance for a predetermined interval with day by day curiosity payouts whereas with versatile staking, DOT is locked up in a user-determined interval however at decrease Interest charges ranging between 20.18% and 0.5% Annual Percentage Yield.

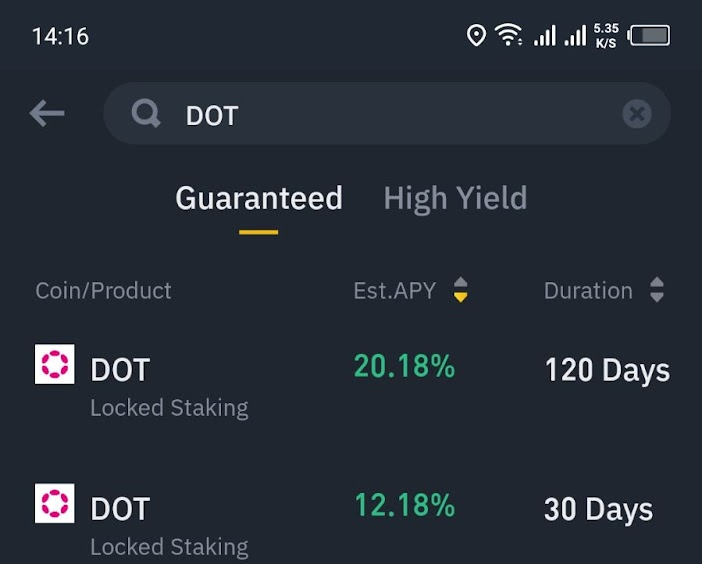

By staking on Kraken you get to hitch their validator nodes with biweekly payouts, the extra you stake the extra you earn with no restrict on when you’ll be able to withdraw. Kraken has excessive Polkadot liquidity so you’ll be able to at all times derive worth out of your cash. Unlike Binance, staking Polkadot on Kraken is on-chain. Passive return Interest charges hover at 12% APY.

Ledger {hardware} pockets ledger system can be utilized to arrange a Polkadot account the identical means with a Polkadot extension pockets to obtain rewards.

How a lot can I earn with Polkadot staking?

Polkadot staking curiosity varies from platform to platform. Binance at present gives the perfect returns at 20.18% with a lock-up interval of 120 days.

Staking on-chain with the Polkadot-js extension will earn you about 10% APY with an possibility of compounding curiosity. Unlike different staking merchandise, staking on Polkadot-js is an lively course of, you must preserve checking to make sure you meet the reward necessities.

Binance locked staking will earn you 20.18% APY locked for 120 days with day by day curiosity payouts. Locking DOT tokens for 30 days will get you 12.18% APY. After the lock-up interval, the principal is shipped to the spot pockets. Flexible staking has an APY of about 0.5%.

Kraken trade gives 12% APY for staking Polkadot.

Is Polkadot staking worthwhile?

Staking Polkadot is worthwhile. In the long term, your DOT rely will develop, nonetheless, its worth is vulnerable to volatility. Polkadot is a well-grounded venture with projections of value progress sooner or later.

Dot slot staking on Binance is worthwhile taking into regard the staking and voting rewards. The worth of successful initiatives additionally determines your profitability for the reason that initiatives aren’t assured of itemizing on Binance.

Withdrawing your Bdot earlier than maturity results in a lack of curiosity on exchanges. On-chain dangerous validators can result in the slashing of Bdot.

Polkadot staking vs mining

Polkadot makes use of a nominated Proof-of-Stake consensus algorithm, whereas Ethereum makes use of a Proof-of-Work consensus algorithm. This means Polkadot makes use of a staking mechanism to validate blocks whereas Ethereum validates transactions by fixing onerous mathematical computations in a course of known as ‘mining blocks’. Ethereum is transitioning from Proof of Work to the environmentally pleasant Proof-of-Stake consensus algorithm.

Next, we’ll examine staking Polkadot and Ethereum mining.

Other initiatives that use a Proof-of-Stake mannequin embrace BNB, SOL, ADA, ATOM, ALGO, RUNE, EGLD, and NEAR protocols.

Benefits of staking Polkadot

- Staking helps safe the community, that means a whale can’t take the community hostage.

- You earn passive returns with the choice of compounding your curiosity.

- Holding Dot offers you the possibility to take part in neighborhood voting for coming messages.

- Staked Dot acts as a measure of the well being of the ecosystem.

- Increasing the whole worth locked will increase the worth of the circulating Dot.

- If Polkadot worth rises you get to earn greater curiosity.

- High and aggressive annual rates of interest.

Drawbacks/dangers of staking Polkadot

- There is a threat of your bonded dot being slashed in case your validator misbehaves.

- Only nominated validators earn staking dot rewards.

- If you lose your custodial pockets personal key you’ll be able to’t get better your Polkadot.

- Staking on non-custodial wallets means your stake depends on the safety of the platform.

- Changes in whole worth can lead to slippage leading to curiosity volatility.

- A Polkadot value crash would lead to losses.

- It is tough to find out sincere validators for nomination.

- Interest charges on exchanges are dictated and may fluctuate.

- High fee charges set by validators imply much less rates of interest for stakers.

- You want no less than 10 DOT to stake with a custodial pockets.

- Only nominators with DOT stake above the unstable quantity can earn extra dot on staking

- The most rely of nominators is capped at 22,500 so you must preserve wanting if you happen to meet the reduce.

- Only 256 nominators on a validator earn rewards.

Conclusion

Staking is an environmentally protected solution to safe the blockchain community whereas incomes curiosity. Staking as a nominator on a sizzling pockets is an lively course of on account of a number of components that would go away your bonded Dot not incomes rewards. Staking as a validator can be a hustle that requires consideration 24/7 to keep away from going astray.

Pooling Polkadot on non-custodial wallets for staking is a extra simple route with comparatively greater long-term returns. The solely threat is that your Bdot might get misplaced when the trade is compromised.

Staking rewards on the finish of the staking interval can be affected by the prevailing worth of DOT.

Staking is an effective way to safe a blockchain and an excellent path to incomes passive revenue.

Leave a Reply