Famous fund supervisor and investor Peter Schiff described a carnage indicator for the cryptocurrency market and expects its realization quickly.

What is the carnage indicator for Bitcoin?

According to the economist, the efficiency of crypto-related shares like Coinbase can trace at digital belongings performing sooner or later as quite a few retail and institutional buyers obtain publicity to the crypto market through crypto-related shares.

Whenever shares are tanking, buyers count on related strikes on the cryptocurrency market because the distribution of funds on the cryptocurrency market usually follows the efficiency on the inventory market. Previously, U.Today highlighted that Bitcoin’s correlation with tech shares stays excessive.

Yes #gold shares acquired clobbered immediately, with the GDX down 5% on a mere $6 drop within the value of gold. But since Feb. tenth the GDX is up 25%. In distinction, The Valkyrie #Bitcoin Miners ETF is down 35%. $10K invested in gold miners = $12.5K. $10K invested in idiot’s gold miners = $6.5K!

— Peter Schiff (@PeterSchiff) April 21, 2022

In distinction to Bitcoin’s efficiency, Schiff displayed the motion of gold-related shares that went by means of a robust correction on April 21 along with $6 drops within the value of gold, however conventional belongings have proven higher efficiency in comparison with Bitcoin. For instance, Valkyrie Miners ETF was down 35% since February, whereas gold mine-related funding merchandise are up 25%.

Schiff stays anti-Bitcoin and pro-gold

Peter Schiff is legendary for his fixed assaults on Bitcoin and help of gold as a greater funding software. Despite the poor efficiency of gold within the final 10 years, Schiff nonetheless believes that Bitcoin is “nugatory” in the long run and shouldn’t be thought-about a secure haven asset or an inflation hedge.

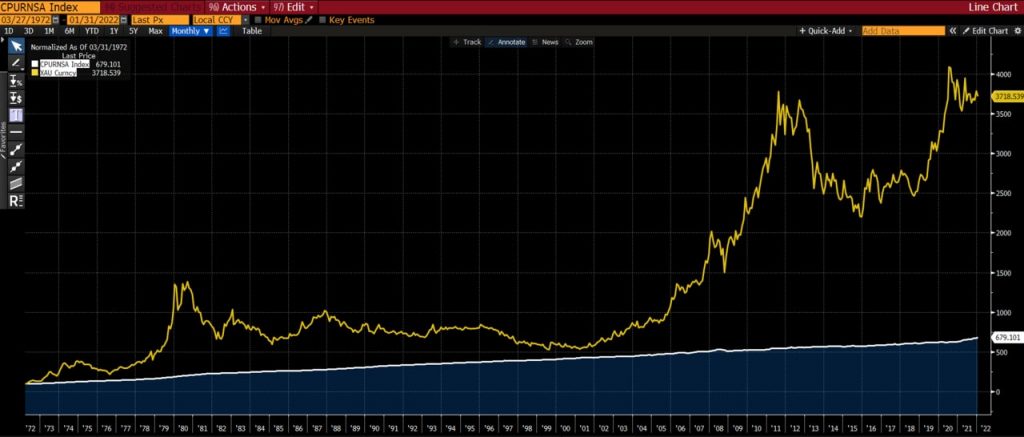

Gold, in actual fact, stays probably the most widespread inflation hedges on this planet because it reveals extraordinarily optimistic efficiency towards the Consumer Price Index for the final 50 years, with the worth of gold exhibiting a 36-fold enhance towards inflation’s 6.8.

Leave a Reply