Leading market makers Flow Traders and Hudson River Trading backed Sei Labs, a new crypto startup that is launching a Layer 1 blockchain developed specifically for trading, according to a report from Bloomberg.

Founded by Goldman Sachs and Robinhood alums Jeff Feng and Jay Jog, Sei Labs aims to build a blockchain that will speed up decentralized finance (DeFi) transactions. It uses code from the Cosmos blockchain and will be able to complete transactions in as little as 600 milliseconds, per a statement provided to Bloomberg.

The investment by Flow Traders and Hudson River Trading comes as part of a $5 million seed round led by Multicoin Capital. Other investors include Coinbase Ventures and GSR, according to the report.

Competing with Solana

The founders of Sei told Bloomberg they hope the network will overtake Solana as a preferred blockchain for building DeFi applications.

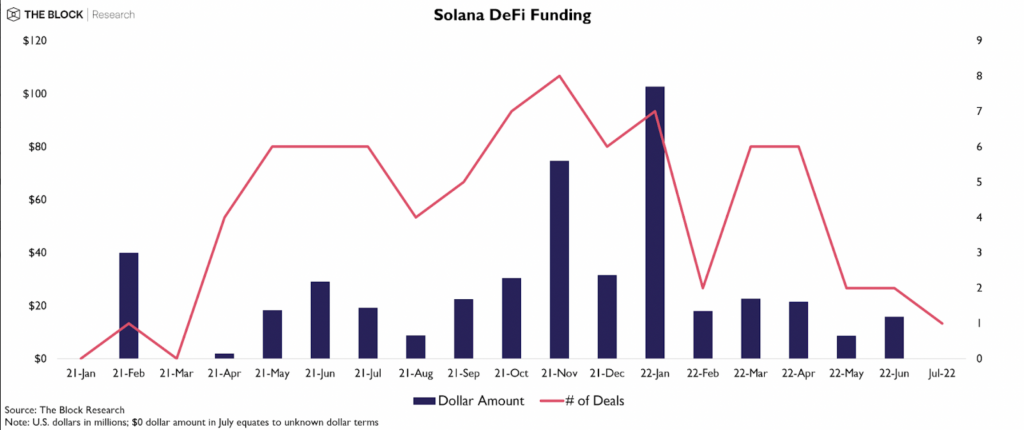

DeFi applications allow individuals to trade, borrow and lend crypto without a central intermediary. In recent months, Solana has seen in its prominence in DeFi decline, as shown by data from The Block Research.

Sei Labs’ lead investor Multicoin Capital is also a prominent investor in Solana. In a recent interview with The Block, Multicoin Capital’s managing partner Tushar Jain explained the firm’s thought process on backing competing Layer 1 blockchains.

“To an outsider it can seem like these things are directly competitive, but really they have chosen different tradeoffs in their technical design. They’re not competing for the same thing,” Jain said, adding that Multicoin wouldn’t back two teams focused on the same tradeoff.

Growing the network

Sei Labs expects the protocol to launch later this year. It will feature a built-in order book that aims to enable market makers and DeFi projects to process transactions at rapid speeds. According to the report, most of the startup’s engineering team hail from Robinhood’s clearing team.

Proceeds from the recent raise will be used to fund growth of the network.

Leave a Reply