The peak of over USD 80,000 was described as “considerably increased” than the present bitcoin worth (USD 40,542 as of Friday at 11:17 UTC), however nonetheless 15% decrease than Finder.com’s end-of-year prediction from January of USD 76,360.

Martin Fröhler, CEO of buying and selling platform Morpher, who gave some of the bullish end-of-year predictions for BTC, commented that,

“Political uncertainty, inflation, and an ever rising want to personal non-government managed belongings will propel Bitcoin to new all-time highs.”

Offering a extra cautious prediction, crypto buying and selling app CoinJar’s CEO Asher Tan mentioned he believes BTC will hit a peak of USD 60,000 this yr.

“There’s nonetheless loads of uncertainty concerning the short-term Bitcoin outlook. Given the macroeconomic headwinds, it will not shock me to see Bitcoin spend the entire yr bouncing round between USD 30-60k – the type of situations which can be horrible for merchants, however rewarding for accumulators with a multi-year timeframe,” Tan mentioned.

Notably, half of the individuals in Finder’s panel, made up of 35 “trade consultants,” mentioned they consider bitcoin will ultimately be overtaken by one other coin as the most well-liked cryptoasset.

Among those that claimed bitcoin’s days as the highest crypto are numbered, Jeremy Cheah, an affiliate professor of decentralized finance at Nottingham Trent University, mentioned the coin “consumes an excessive amount of vitality and suffers from interoperability and scalability issues.”

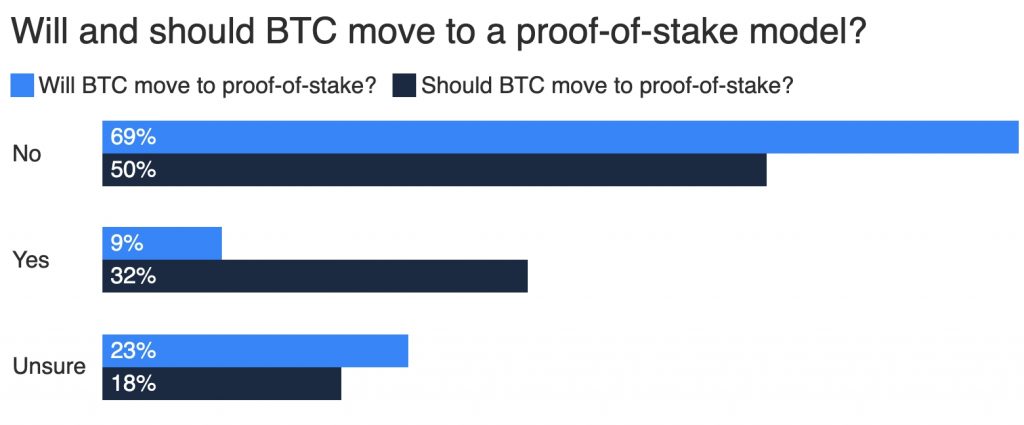

Meanwhile, 32% of the panelists additionally mentioned they suppose that BTC ought to transfer from the extra energy-intensive proof-of-work (PoW) mannequin to proof-of-stake (PoS). However, solely 9% mentioned they consider BTC will really make the transfer.

Overall, 67% of respondents mentioned BTC continues to be a very good purchase, regardless of their worth predictions being decrease now than within the final survey from January.

24% of the respondents opined that customers who already maintain BTC mustn’t promote it, whereas 9% mentioned that BTC holders ought to promote the cash they’ve.

Leave a Reply